Lithium-Ion Battery Manufacturing Equipment Market by Type (Electrode Manufacturing, Cell & Battery Assembly, and others), Industrial Application (Consumer Electronics, Automotive), Mode of Operation - Global Analysis and Forecast to 2025

Industry: Semiconductor & Electronics | Report Pages: 141 | List of Tables: 91 | List of Figures: 57 | Format :

Published Date: July 2018

PowerPoint Format

Data Analysis Sheet

PDF Format

Lithium-Ion Battery Manufacturing Equipment Market

The lithium-ion battery manufacturing equipment market is expected to grow at a CAGR of 5.3% from 2018 to 2025, to USD 1.9 billion by 2025. The growth in the lithium-ion battery manufacturing equipment segment is due to the increase in its demand across various applications such as consumer electronics, automotive, and others. There are multiple steps in the manufacturing of a lithium-ion battery, which require different types of equipment. The market and equipment types are differentiated on the basis of cell and battery, due to their structure and functions. The difference between a cell and a battery is that a cell is a single unit that converts chemical energy into electrical energy, and a battery is a collection of cells.

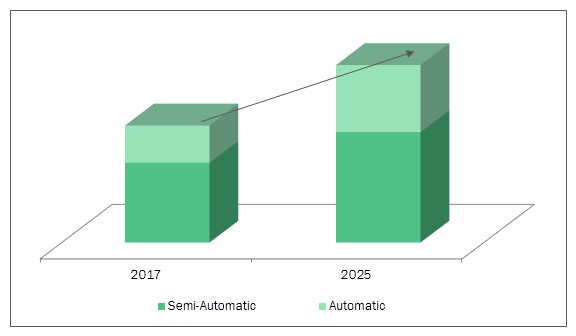

Figure1: Lithium-Ion Battery Manufacturing Equipment Market, By Mode of Operation, 2017 (USD Million)

Lithium-ion battery manufacturing equipment supplements different manufacturing requirements and is available in automatic and semi-automatic operating modes. The differentiation varies on the basis of function and cost between the machines. Automatic machines are quick in carrying out the required task; however, they are expensive to develop and are limited to a set of functions. Semi-automatic machines provide a greater degree of flexibility and human intervention to ensure the process is carried out as required. The lower cost of purchase and operation makes them the desired choice for battery manufacturing companies. The applications of lithium-ion batteries have seen a considerable increase with developments in technology. The use of lithium-ion batteries in various consumer electronic devices has seen an increase in new technologies such as smart wear products. The use of electric cars is also expected to witness significant growth over the next decade, due to an increased focus on electric drivetrains due to strong emission regulations.

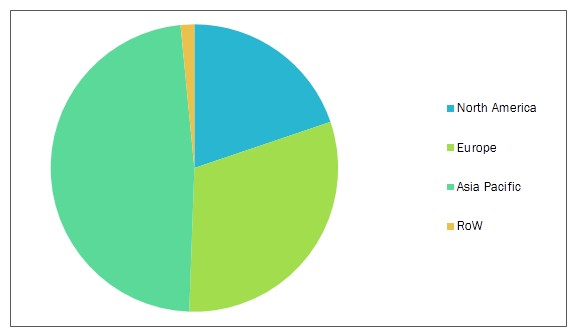

The Asia-Pacific region holds the largest market share in the lithium-ion battery manufacturing segment. There is a strong presence of battery and equipment manufacturers in the region, which supports the development of the segment. The proximity to major reserves such as Australia also strengthens the battery market in the region.

The lithium-ion battery manufacturing market is highly competitive and includes companies such as Siemens, Hitachi High technologies, Targray, Sovema Group, Manz, Greenlight Innovation, Gelon Lib Group, Xiamen Tob New Energy technology Group, Wirtz USA, and Bryer-extr.

Scope of the Study

- Lithium-Ion Battery Manufacturing Equipment Market, by Type

- Electrode Manufacturing Equipment

- Cell & Battery Assembly Equipment

- Testing & Formation Equipment

- Research & Development Equipment

- Lithium-Ion Battery Manufacturing Equipment Market, by Industrial Application

- Consumer Electronics

- Automotive

- Industrial

- Others

- Lithium-Ion Battery Manufacturing Equipment Market, by Mode of Operation

- Automatic

- Semi-Automatic

- Lithium-Ion Battery Manufacturing Equipment Market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

This report provides an in-depth study of key companies and competitive analysis of developments recorded in the industry in the last eight years. In this report, market dynamics such driver, barriers, opportunities, challenges, and factor analysis are discussed in detail. Key market players such as Siemens, Hitachi High technologies, Targray, Sovema Group, and Manz are profiled to provide an insight into the competitive scenario of the global lithium-ion battery manufacturing equipment market.

1 Introduction

1.1 Key Research Objectives

1.2 Market Definition

1.3 Report Scope

1.3.1 Segmental Scope

1.4 Regional Scope

1.5 Currency & Conversion

1.6 Research Methodology

1.6.1 Market Size Estimation & Data Triangulation

1.6.2 Key Sources

1.6.3 Research Assumptions & Limitations

2 Executive Summary

2.1 Overview

2.2 lithium-ion battery manufacturing equipment market: By type

2.3 Lithium-Ion Battery Manufacturing Equipment: By industrial application

2.4 Lithium-Ion Battery Manufacturing Equipment: By mode of operation

2.5 Asia-Pacific is the Fastest Growing Region

2.6 Key Strategic Development

3 MARKET OVERVIEW

3.1 Market Dynamics

3.1.1 Factor Analysis

3.1.1.1 Introduction

3.1.1.2 Overview of Parent Industry

3.1.1.3 Demand Side Analysis

3.1.1.4 Rise in Population

3.1.1.5 Increase in Use of Hand-Held Devices and Electric Cars

3.1.1.6 Increase in Per-Capita GDP

3.1.1.7 Supply-Side Analysis

3.1.1.8 Research & Development

3.1.1.9 Lithium-Ion Battery Manufacturing Equipment & Technology

3.1.2 Drivers 34

3.1.2.1 Growing Demand for Electric Batteries from Automobile Manufacturers

3.1.2.2 Growing Demand for Energy Storage Solutions

3.1.2.3 Cost-Effectiveness Compared to Manufacturing of Other Batteries

3.1.3 Barriers

3.1.3.1 Development of Graphene and Solid State Batteries

3.1.3.2 Increasing Preference and Development of Fuel-Cell Technologies

3.1.4 Opportunities

3.1.4.1 Regulations Banning Sale of ICE Cars will Benefit Electric Vehicles Development

3.1.4.2 Increasing demand for Automated Equipment to Reduce Operational Costs and Time to Market

3.1.5 Challenges

3.1.5.1 High Up-Front Costs of Machinery and Equipment

3.1.5.2 Volatility in Material Handling

4 INDUSTRY ANALYSIS

4.1 Porter’s Five Forces Model

4.1.1 Degree of Competition

4.1.2 Bargaining Power of Suppliers

4.1.3 Bargaining Power of Buyers

4.1.4 Threat of Substitutes

4.1.5 Threat Of New Entrants

4.2 Supply Chain Analysis

4.3 Regulations

5.LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE

5.1 INTRODUCTION

5.2 ELECTRODE MANUFACTURING EQUIPMENT

5.2.1 SLURRY MIXING

5.2.2 COATING

5.2.3 DRYING

5.2.4 CALENDERING

5.2.5 CUTTING

5.3 CELL & BATTERY ASSEMBLY EQUIPMENT

5.3.1 STACKING & WINDING EQUIPMENT

5.3.2 PACKAGING

5.3.3 TEMPORARY SEALING

5.3.4 DRYING

5.3.5 FILLING

5.3.6 PERMANENT SEALING

5.4 FORMATION & TESTING EQUIPMENT

5.5 RESEARCH & DEVELOPMENT EQUIPMENT

6. LITHIUM-ION BATTERY MANFUACTURING EQUIPMENT MARKET, BY MODE OF OPERATION

6.1 INTRODUCTION

6.2 AUTOMATIC

6.3 SEMI-AUTOMATIC

7 LITHIUM-ION BATTERY MANFUACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION

7.1 INTRODUCTION

7.2 CONSUMER ELECTRONICS

7.3 AUTOMOTIVE

7.4 INDUSTRIAL

7.5 OTHERS

8 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT, BY REGION

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 BY COUNTRY

8.2.2 BY INDUSTRIAL APPLICATION

8.2.3 BY MODE OF OPERATION

8.2.4 KEY COUNTRY-WISE INSIGHTS

8.2.4.1 USA

8.2.4.1.1 By Type

8.2.4.1.2 By Industrial Application

8.2.4.1.3 By Mode of Operation

8.2.4.2 Canada

8.2.4.2.1 By Type

8.2.4.2.2 By Industrial Application

8.2.4.2.3 By Mode of Operation

8.2.4.3 Mexico

8.2.4.3.1 By Type

8.2.4.3.2 By Industrial Application

8.2.4.3.3 By Mode of Operation

8.3 EUROPE

8.3.1 BY COUNTRY

8.3.2 BY TYPE

8.3.3 BY INDUSTRIAL APPLICATION

8.3.4 BY MODE OF OPERATION

8.3.5 KEY COUNTRY-WISE INSIGHTS

8.3.5.1 Germany

8.3.5.1.1 By Type

8.3.5.1.2 By Industrial Application

8.3.5.1.3 By Mode of Operation

8.3.5.2 France

8.3.5.2.1 By Type

8.3.5.2.2 By Industrial Application

8.3.5.2.3 By Mode of Operation

8.3.5.3 Rest of Europe

8.3.5.3.1 By Type

8.3.5.3.2 By Industrial Application

8.3.5.3.3 By Mode of Operation

8.4 ASIA-PACIFIC

8.4.1 BY COUNTRY

8.4.2 BY TYPE

8.4.3 BY INDUSTRIAL APPLICATION

8.4.4 BY MODE OF OPERATION

8.4.5 KEY COUNTRY-WISE INSIGHTS

8.4.5.1 China

8.4.5.1.1 By Type

8.4.5.1.2 By Industrial Application

8.4.5.1.3 By Mode of Operation

8.4.5.2 Japan

8.4.5.2.1 By Type

8.4.5.2.2 By Industrial Application

8.4.5.2.3 By Mode of Operation

8.4.5.3 South Korea

8.4.5.3.1 By Type

8.4.5.3.2 By Industrial Application

8.4.5.3.3 By Mode of Operation

8.4.5.4 Rest of Asia-Pacific

8.4.5.4.1 By Type

8.4.5.4.2 By Industrial Application

8.4.5.4.3 By Mode of Operation

8.5 REST OF THE WORLD

8.5.1 BY COUNTRY

8.5.2 BY TYPE

8.5.3 BY INDUSTRIAL APPLICATION

8.5.4 BY MODE OF OPERATION

8.5.5 KEY REGION-WISE INSIGHTS

8.5.5.1 South America

8.5.5.1.1 By Type

8.5.5.1.2 By Industrial Application

8.5.5.1.3 By Mode of Operation

8.5.5.2 Middle East & Africa

8.5.5.2.1 By Type

8.5.5.2.2 By Industrial Application

8.5.5.2.3 By Mode of Operation

9. COMPETITIVE LANDSCAPE

9.1 INTRODUCTION

9.2 KEY STRATEGIC DEVELOPMENTS

9.2.1 OVERVIEW

9.2.2 PARTNERSHIPS

9.2.3 NEW PRODUCT DEVELOPMENTS & LAUNCHES

9.2.4 ACQUISITIONS

9.2.5 BUSINESS STRATEGIES

9.2.6 PRODUCT OFFERINGS

10 COMPANY PROFILES

10.1 INTRODUCTION

10.2 SIEMENS

10.2.1 BUSINESS OVERVIEW

10.2.2 SIEMENS: SWOT ANALYSIS

10.2.3 CONVERGED MARKETS’ VIEW

10.3 HITACHI TECHNOLOGIES

10.3.1 BUSINESS OVERVIEW

10.3.2 HITACHI TECHNOLOGIES: SWOT ANALYSIS

10.3.3 CONVERGED MARKETS’ VIEW

10.4 TARGRAY

10.4.1 BUSINESS OVERVIEW

10.4.2 TARGRAY: SWOT ANALYSIS

10.4.3 CONVERGED MARKETS’ VIEW

10.5 MANZ AG

10.5.1 BUSINESS OVERVIEW

10.5.2 MANZ AG: SWOT ANALYSIS

10.5.3 CONVERGED MARKETS’ VIEW

10.6 SOVEMA GROUP

10.6.1 BUSINESS OVERVIEW

10.6.2 SOVEMA GROUP: SWOT ANALYSIS

10.6.3 CONVERGED MARKETS’ VIEW

10.7 WIRTZ USA

10.7.1 BUSINESS OVERVIEW

10.7.2 CONVERGED MARKETS’ VIEW

10.8 GELON LIB GROUP

10.8.1 BUSINESS OVERVIEW

10.8.2 CONVERGED MARKETS’ VIEW

10.9 BREYER GMBH

10.9.1 BUSINESS OVERVIEW

10.9.2 CONVERGED MARKETS’ VIEW

10.10 XIAMEN TOB NEW ENERGY TECHNOLOGY CO.

10.10.1 BUSINESS OVERVIEW

10.10.2 CONVERGED MARKETS’ VIEW

10.11 GREENLIGHT INNOVATION

10.11.1 BUSINESS OVERVIEW

10.11.2 CONVERGED MARKETS’ VIEW

11 APPENDIX

11.1 DISCUSSION GUIDE

11.2 AVAILABLE CUSTOMIZATIONS

LIST OF TABLES

TABLE 1 KEY SECONDARY SOURCES

TABLE 2 KEY PRIMARY SOURCES

TABLE 3 ASSUMPTIONS

TABLE 4 LIMITATIONS

TABLE 5 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, DRIVERS, BARRIERS, OPPORTUNITIES & CHALLENGES

TABLE 6 UN TESTS FOR LITHIUM CELLS AND BATTERIES PRIOR TO BEING TRANSPORTATION

TABLE 7 ADDITIONAL INTERNATIONAL STANDARDS

TABLE 8 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016–2025 (USD BILLION)

TABLE 9 ELECTRODE MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 10 CELL & BATTERY ASSEMBLY EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 11 TESTING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 12 RESEARCH & DEVELOPMENT EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 13 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016–2025 (USD MILLION)

TABLE 14 AUTOMATIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD MILLION)

TABLE 15 SEMI-AUTOMATIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD MILLION)

TABLE 16 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016–2025 (USD BILLION)

TABLE 17 CONSUMER ELECTRONICS: LITHIUM ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 18 AUTOMOTIVE: LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 19 INDUSTRIAL: LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 20 OTHERS: LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD BILLION)

TABLE 21 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2016-2025 (USD MILLION)

TABLE 22 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

TABLE 23 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 24 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 25 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 26 USA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 27 USA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 28 USA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 29 CANADA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 30 CANADA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 31 CANADA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 32 MEXICO LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 33 MEXICO LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 34 MEXICO LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 35 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

TABLE 36 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 37 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 38 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 39 GERMANY LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 40 GERMANY LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 41 GERMANY LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 42 FRANCE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 43 FRANCE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 44 FRANCE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT, BY MODE OF OPERATION 2016-2025 (USD MILLION)

TABLE 45 REST OF EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 46 REST OF EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 47 REST OF EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 48 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

TABLE 49 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 50 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 51 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 52 CHINA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 53 CHINA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 54 CHINA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 55 JAPAN LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 56 JAPAN LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 57 JAPAN LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 58 SOUTH KOREA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 59 SOUTH KOREA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDSUTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 60 AUSTRALIA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 61 REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 62 REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 63 REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION) 97

TABLE 64 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

TABLE 65 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2016-2025 (USD MILLION)

TABLE 66 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDSUTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 67 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 68 SOUTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 69 SOUTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDSUTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 70 BRAZIL LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

TABLE 72 MIDDLE EAST & AFRICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

TABLE 73 MIDDLE EAST & AFRICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

TABLE 74 SIEMENS: PRODUCTS OFFERED

TABLE 75 SIEMENS: KEY STRATEGIC DEVELOPMENTS

TABLE 76 HITACHI TECHNOLOGIES: PRODUCTS OFFERED

TABLE 77 HITACHI TECHNOLOGIES: KEY STRATEGIC DEVELOPMENT

TABLE 78 TARGRAY: PRODUCTS OFFERED

TABLE 79 TARGRAY: KEY STRATEGIC DEVELOPMENTS

TABLE 80 MANZ AG: PRODUCTS OFFERED

TABLE 81 MANZ AG: KEY STRATEGIC DEVELOPMENTS

TABLE 82 SOVEMA GROUP: PRODUCTS OFFERED

TABLE 83 SOVEMA GROUP: KEY STRATEGIC DEVELOPMENTS

TABLE 84 WIRTZ USA: PRODUCTS OFFERED

TABLE 85 GELON LIB GROUP: PRODUCTS OFFERED

TABLE 86 GELON LIB GROUP: KEY STRATEGIC DEVELOPMENT

TABLE 87 GELON LIB GROUP: PRODUCTS OFFERED

TABLE 88 XIAMEN: PRODUCTS OFFERED

TABLE 89 XIAMEN: KEY STRATEGIC DEVELOPMENTS

TABLE 90 GREENLIGHT INNOVATION: PRODUCTS OFFERED

TABLE 91 GREENLIGHT INNOVATION: KEY STRATEGIC DEVELOPMENT

LIST OF FIGURES

FIGURE 1 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET

FIGURE 3 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET: RESEARCH DESIGN

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGIES: TOP-DOWN & BOTTOM-UP APPROACH

FIGURE 5 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET SIZE, BY REGION, 2017 (USD BILLION)

FIGURE 6 CELL & BATTERY EQUIPMENT HAD LARGEST MARKET SHARE IN 2017

FIGURE 7 AUTOMOTIVE SEGMENT TO DRIVE BATTERY MANUFACTURING EQUIPMENT DEMAND BY 2025

FIGURE 8 SEMI-AUTOMATIC EQUIPMENT SEGMETNT DOMINATES MANUFACTURING EQUIPMENT MARKET

FIGURE 9 ASIA-PACIFIC: LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET SHARE, BY COUNTRY & APPLICATION

FIGURE 10 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT GROWTH, BY COUNTRY, 2017

FIGURE 11 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT: KEY STRATEGIC DEVELOPMENT

FIGURE 12 COMPETITIVE ANALYSIS OF KEY PLAYERS

FIGURE 13 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET: COMPANY SHARE ANALYSIS

FIGURE 14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 SUPPLY CHAIN ANALYSIS

FIGURE 16 CELL & BATTERY ASSEMBLY EQUIPMENT SEGMENT HELD THE LARGEST MARKET SHARE IN 2017

FIGURE 17 SEMI-AUTOMATIC SEGMENT HELD LARGEST MARKET SHARE IN 2017

FIGURE 18 AUTOMOTIVE SEGMENT TO LEAD LITHIUM-ION BATTER MANUFACTURING EQUIPMENT MARKET

FIGURE 19 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION, 2017 (USD MILLION)

FIGURE 20 ASIA PACIFIC IS ESTIMATED TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 21 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

FIGURE 22 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

FIGURE 23 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

FIGURE 24 NORTH AMERICA LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

FIGURE 25 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

FIGURE 26 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

FIGURE 27 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

FIGURE 28 EUROPE LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

FIGURE 29 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT, COUNTRY SNAPSHOT, 2017

FIGURE 30 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION)

FIGURE 31 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION)

FIGURE 32 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

FIGURE 33 ASIA-PACIFIC LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

FIGURE 34 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2016-2025 (USD MILLION) 98

FIGURE 35 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2016-2025 (USD MILLION) 99

FIGURE 36 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY INDUSTRIAL APPLICATION, 2016-2025 (USD MILLION)

FIGURE 37 ROW LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT MARKET, BY MODE OF OPERATION, 2016-2025 (USD MILLION)

FIGURE 38 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT, 2016-2018

FIGURE 39 COMPETITIVE MATRIX

FIGURE 40 COMPANY SHARE ANALYSIS, 2017

FIGURE 41 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT: BUSINESS STRATEGIES

FIGURE 42 LITHIUM-ION BATTERY MANUFACTURING EQUIPMENT: PRODUCT OFFERING

FIGURE 43 SIEMENS: COMPANY OVERVIEW

FIGURE 44 SIEMENS: SWOT ANALYSIS

FIGURE 45 HITACHI TECHNOLOGIES: COMPANY OVERVIEW

FIGURE 46 HITACHI TECHNOLOGIES: SWOT ANALYSIS

FIGURE 47 TARGRAY: COMPANY OVERVIEW

FIGURE 48 TARGRAY: SWOT ANALYSIS

FIGURE 49 MANZ AG: COMPANY OVERVIEW

FIGURE 50 MANZ AG: SWOT ANALYSIS

FIGURE 51 SOVEMA GROUP: COMPANY OVERVIEW

FIGURE 52 SOVEMA GROUP SWOT ANALYSIS

FIGURE 53 WIRTZ USA: COMPANY OVERVIEW

FIGURE 54 GELON LIB GROUP: COMPANY OVERVIEW

FIGURE 55 BREYER GMBH: COMPANY OVERVIEW

FIGURE 56 XIAMEN: COMPANY OVERVIEW

FIGURE 57 GREENLIGHT INNOVATION: COMPANY OVERVIEW 135

The lithium-ion battery manufacturing equipment market is expected to grow at a CAGR of 5.3%, to reach USD 1.9 billion by 2025. The market for lithium-ion battery manufacturing equipment experiences significant growth due to the increase in demand for lithium-ion batteries in multiple sectors. The improvement in the economic scenario and technological developments has resulted in high demand for consumer electronics and electric cars, which constitute a large part of the battery market. The manufacturing process involves multiple stages for which different types of equipment are required.

The lithium-ion battery manufacturing market is classified on the basis of equipment type, industrial application, and mode of operation. The various types of equipment include electrode manufacturing equipment, cell & battery assembly equipment, testing & formation equipment, and research & development equipment. The industrial applications are segmented into consumer electronics, automotive, industrial, and others. The mode of operation is classified into automatic and semi-automatic equipment.

Figure1: Lithium-Ion Battery Manufacturing Equipment Market, By Region, 2017 (USD Million)

The cell & battery assembly equipment forms a large part of the equipment type segment, which comprises multiple machine functions in the manufacturing process. The electrode manufacturing segment is close behind; however, the R&D; equipment is expected to emerge as the fastest growing segment due to the increase in demand for specialized technologies.

In terms of industrial application, the automotive sector and the consumer electronics segment are among the leading buyers of lithium-ion battery manufacturing equipment. Automotive is the fastest and largest growing segment in the lithium-ion batteries market due to the looming regulations from countries such as Germany and France. The developments in battery technologies and mobility solutions such as solid-state batteries and supercapacitors are expected to bolster the development of lithium-ion batteries in the sector.

The Asia-Pacific region is the largest and fastest growing region in the lithium-ion battery manufacturing equipment market. Countries such as China and Japan are the major player's industry. China has a robust manufacturing sector and industry-friendly policies that have allowed for better development. The region’s proximity to major lithium reserves and battery manufacturing units lends a geographic advantage.

The lithium-ion battery manufacturing equipment market is in its growth stages but has varying degrees of competition which is dependent on the region. The players profiled in the market include Siemens, Hitachi High Technologies, Targray, Manz, Sovema Group, Bryer-extr, Greenlight Innovation, Xiamen Tob New Energy, and the Gelon Lib Group.